In principle, the application process for a loan should be straightforward, but this isn’t always the case. Before choosing a loan, there are many things to think about and facts that you need to comprehend.

It would be best first to determine your credit score and the types of interest rates and conditions you are eligible for. It would be best if you decided how much you can comfortably borrow. Other home-buying expenses to consider if you’re getting a mortgage include appraisals, inspections, and closing charges.

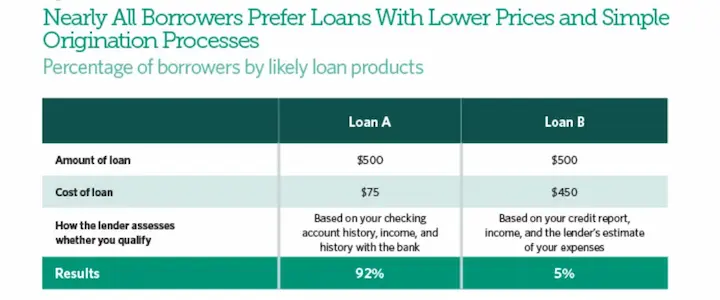

It would be best to watch out for lender origination costs, regardless of the loan you are looking for. Mortgage and personal loan origination fees are just two examples of the costs of loan origination you may encounter.

Although many lenders impose origination fees, the names they use and the sums they want might differ considerably. Here are some things you should know about origination costs before choosing a lender to choose the best kind of borrowing for your financial position.

Everything You Should Know About Loan Origination Fees

Be ready to pay for various closing charges if you’re taking out a home mortgage to finance the purchase of a property. The single origination fee is often the most expensive closing expense, along with Direct loan origination costs.

How to Pay Less in Origination Fees for Home Loans

Any loan’s interest rate is crucial, but you must consider the single origination fee and Direct loan origination costs. These up-front charges come out of funds that you would want to use for house improvements, new furnishings, or relocation expenses.

Main Points

- You must pay loan origination costs, including the single origination fee, to your lender for them to complete your loan application.

- Several methods to save money on these Direct loan origination costs include comparison shopping, lender credits, and bargaining.

- Fees may vary from 0.5% to 2%, and smaller costs are often associated with bigger loans.

What Are Origination Fees For Loans?

Your loan officer or mortgage broker charges you the loan origination fee for providing you with the loan and performing all the work, including documentation, verifications, and computations, to finance the loan. A percentage or point represents the origination charge. You must pay the loan origination fee at the closing of the house transaction.

Faith-Based Estimate (GFE)

The cost of loan origination fees varies depending on several variables, including the lender you’re working with, the services they charge for, the kind of loan you’ve taken out, and the amount of the loan you’re taking out. Lenders provide good-faith estimates since you’ll want to know the price before closing your house. The projected closing expenses are shown in a good-faith estimate, so you can understand how much your loan origination fee is likely to be. After receiving your loan application, lenders have three days to provide a good-faith estimate. These estimates usually include the dollars for origination charges and other relevant loan costs.

The Average Origination Fee for Loans

When considering different loan options, it’s important to know the average dollars for origination charges. By comparing these fees between lenders, you can make a more informed decision on which loan is the most cost-effective for you.

The average loan charge is around 1%. However, most borrower fees and credit fees range between 0.5 and 1 percent. The origination charge will increase proportionately to how much effort is involved in completing the transaction. A loan will be a higher risk if the borrower doesn’t have strong credit and might have higher borrower fees.

The Maximum Origination Fee for Loans

The maximum origination fee for loans can vary depending on the type of loan and the lender. However, regulations are generally in place to limit the fees that lenders can charge. For example, the Consumer Financial Protection Bureau (CFPB) has established guidelines for qualified mortgages in the United States, which cap the origination fees at 3% of the loan amount. Additionally, some states may have their regulations governing origination fees. It’s important to review the terms and conditions of your loan agreement to understand the specific origination fee limits that apply to your situation.

What Does A Loan Origination Fee Include?

While some lenders impose a single loan origination fee, others break the cost down item by item. Regardless of the circumstances, the cost will pay for several services, such as assembling the required paperwork, submitting the application, validating all the information in your papers, and processing the loan.

What Must You Understand?

You should be aware of the following before paying the loan origination fee:

The payment must be complete.

Before closing the property, you must fully pay the loan origination fee. It implies that you cannot pay your lender the cost via a payment plan of any form. Since lenders cannot accept personal checks or cash, so you must also pay via a cashier’s check.

It’s Not Like A Down Payment

The property purchase does not include the loan origination fee but covers your down payment. The loan origination fee is a cost associated with financing; it does not affect the loan you ultimately get. Your down payment may also impact the terms of your loan (at least for traditional loans) since it can lower your interest rate and decrease the size of your monthly payments.

Higher Percentage-Based Fees Could Apply to Smaller Homes.

Mortgage brokers and loan officers earn their pay through commissions. The mortgage broker or loan officer will make less money if you purchase a smaller home since you’ll take out a smaller loan. The loan origination charge may increase as lenders base the commission on a percentage of the smaller loan.

How to Reduce Your Origination Fees for Loans?

Even while the loan origination cost is what your lender charges for their services, there are still several ways you may be able to reduce it. Lenders may be ready to forgo the cost if you are a low-risk borrower entirely (you have outstanding credit and a high-paying job, for example). You are a low-risk borrower. Therefore they are sure they can sell your loan to an investor. When they sell it, they’ll be able to recoup their commission.

If you look around and get cheaper loan origination rates from other lenders, you may also bargain with your mortgage broker or loan officer. If you remain a client, they might be willing to lower their prices.. Another option is to propose paying a higher interest rate in exchange for a reduced or waived loan origination charge. It will increase the lender’s perceived value of the loan, making it more straightforward for them to sell it and make a profit.

Another option is for the seller to contribute to the loan origination charge. Particularly if they don’t have any other potential bidders and the home has been on the market for a while, some sellers could be ready to assist in ensuring the sale of the property goes through.

What Makes a Discount Point Unique?

You owe your mortgage broker or loan officer a charge called a loan origination fee in exchange for their services. The value of discount points equals the points used to calculate your loan origination charge. In essence, each issue equals 1% of the loan, although they are not the same. You may purchase discount points in advance to lower your interest rate. As “buying down your rate,” this is done.

Do You Finance Origination Fees?

To avoid paying the loan origination fee upfront, roll the closing fees into the loan. Sadly, this isn’t permitted. No VA or conventional loans enable this. The FHA may accept it, but an appraisal is required. The loan plus closing expenses cannot exceed 96.5 percent of the home’s assessed value or selling price (whichever is less). The USDA loan is the only form that permits you to roll your origination cost into the loan. You’ll pay more in monthly mortgage payments and interest throughout the life of the loan.

How Each Lender Differs

Loan origination fees vary across lenders. The causes are various. Some lenders may not charge an origination fee with good credit and finances—some lenders list costs instead of a single origination charge. If so, your good faith loan estimate will include underwriting fees, application, and processing fee costs.

Frequently Asked Questions

What are loan origination fees, and how do they work?

Loan origination fees are one-time administrative charges to process and underwrite a new loan, typically 1-6% of the total loan amount.

Are there any strategies to negotiate or reduce loan origination fees?

Strategies include comparing lenders, asking for fee waivers, increasing down payment, and taking lender credits.

Can I avoid loan origination fees altogether when obtaining a loan?

It’s very difficult to avoid loan origination fees completely, but online lenders sometimes offer no-fee loans.

What types of loans typically have higher origination fees, and which ones have lower fees?

Personal loans and credit cards have higher fees, while auto, home, and student loans typically have lower origination fees.

Are there any legal regulations or guidelines that lenders must follow regarding loan origination fees?

The Truth in Lending Act requires lenders to disclose origination fees upfront. Some states cap maximum allowable origination fees.