Credit unions have become increasingly popular in recent years, especially among people looking for an alternative to traditional payday or title lenders. The main advantage of a credit union is its focus on community and member-owned operations. Credit unions operate as nonprofit organizations that their members rather than shareholders own.

As such, they prioritize providing their members with affordable loans, savings accounts, and other financial services over generating profits. Payday and title lenders operate primarily for profit-making purposes with high-interest rates that sometimes trap borrowers into cycles of debt. Choosing a credit union over such lenders enables individuals to benefit from lower interest rates and fees while supporting a local institution that prioritizes the needs of its members.

Understanding The Differences Between Credit Unions And Payday/Title Lenders

Credit Union vs. Payday Lender. Key Differences are numerous, but the most significant is that credit unions operate as not-for-profit entities. It means they belong to their members, who have a say in how to run the institution. Payday and title lenders are for-profit businesses that prioritize generating revenue over serving customers.

Another key difference between the financial institutions lies in membership requirements. An individual must meet specific eligibility criteria, such as living or working within a certain geographic area or belonging to a particular profession or organization, to join a credit union. Payday and title lenders do not require membership. Anyone is able to apply for a loan regardless of their background or financial situation. The average fee for an initial payday loan of $375 is $520, according to Debthammer.

| Detail | Value |

|---|---|

| Average fee for an initial payday loan of $375 | $520 |

| Demographics most likely to have a payday loan | People without a college degree, renters, those earning less than $40,000 a year, and people who are separated or divorced |

| Reasons for payday loan usage | To pay bills each month, including utilities, car payments, or other debt obligations |

| Percentage of payday loans that are rolled over | More than 80% |

| Percentage of repeat borrowers | 75% |

| Percentage of one-time borrowers | 60% |

The Importance Of Interest Rates In Loan Repayment

Interest rates play a significant role in the repayment of loans. You must review interest rates when choosing between lenders, as they greatly impact the overall cost of borrowing. Credit unions offer lower interest rates than payday or title lenders, making them a more attractive option for people looking for affordable loan options.

Loan terms are a key factor in loan repayment. Credit unions offer longer loan terms than payday or title lenders, giving borrowers more time to repay their loans without causing financial strain. It allows individuals to plan their finances accordingly and avoid defaulting on their loans. Credit union members have access to financial planning resources that help them make informed decisions about managing debt and improving their financial stability.

Loan consolidation is another potential benefit provided by credit unions which helps reduce monthly payments by combining multiple debts into one manageable payment with lower interest rates. Borrowers must evaluate it carefully to verify that it is financially beneficial over the long term while reviewing its impact on their credit scores.

How Credit Unions Keep Interest Rates Low

Credit unions are financial institutions that operate under a cooperative structure. Members own the credit union and elect their board of directors, which makes decisions about the institution’s direction and offerings. Such a democratic approach results in lower loan interest rates because members have more control over how they use the profits.

- Credit unions tend to have membership requirements, such as living or working in a particular area or belonging to a group like a labor union. The requirements help create a community among members and foster trust within the institution.

- Credit unions’ nonprofit status allows them to focus on serving their members rather than turning a profit for shareholders. They do not pay taxes on earnings, further reducing overhead costs and allowing them to offer competitive loan rates.

- Credit unions prioritize building relationships with their members by offering personalized services tailored to individual needs instead of trying to maximize profits through high-interest loans. The emphasis on community-focused banking practices helps promote financial literacy and stability while fostering stronger ties between individuals and communities within the cooperative structure of credit unions.

The Benefits Of Choosing A Credit Union For Your Loan

There are many benefits associated with credit union loans.

- Credit unions offer lower interest rates than traditional lenders, such as payday or title lenders, making them a more affordable option for borrowers.

- Credit unions offer more flexible payment options, allowing borrowers to make payments over a longer period. It helps make loan payments more manageable for borrowers.

- Credit unions have more lenient credit requirements and are willing to work with borrowers to obtain financing.

- Lastly, credit unions are nonprofit organizations, meaning that any fees or other costs associated with the loan are likely lower than traditional lenders.

Lower Interest Rates

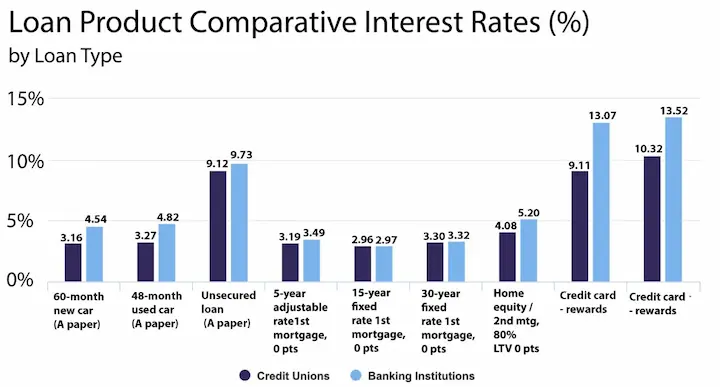

Have you ever thought of the advantages of borrowing from a credit union rather than a payday or title lender? One notable benefit is lower interest rates. Credit unions are not-for-profit financial institutions that prioritize their members’ interests and offer loans at competitive rates compared to traditional lenders. According to recent studies, credit unions charge an average of 3% less interest rates on personal loans than banks.

The difference seems small but has a substantial economic impact over time. Lower interest rates mean lower monthly payments, leading to more money in your pocket. Credit unions perform thorough risk assessments before approving loans to verify that borrowers are able to repay them without defaulting. The approach provides consumer protection while making loan accessibility easier for people with fair or poor credit scores turned away by other lenders based solely on their scores.

Flexible Payment Options

Credit unions provide flexible payment options for borrowers. It means you are able to choose a repayment plan that suits your financial situation and schedule.

Credit unions understand that every borrower has unique needs, so they offer customized plans with adjustable schedules and personalized options. They allow you to skip a payment or adjust the due date without penalty fees if you have an irregular income or unexpected expenses.

They offer grace periods before payments are due or automatic deductions from your paycheck or account. Such adaptable terms give borrowers more control over their loan repayment and reduce the risk of default.

The Risks And Pitfalls Of Payday And Title Lenders

Payday and title lenders have a few risks that borrowers must know before obtaining a loan.

- Payday and Title lenders charge high-interest rates, which make it difficult for borrowers to repay the loans. Unregulated lending by a few lenders makes it difficult to know what the loan entails and the conditions for repayment.

- Payday and Title lenders easily trap borrowers in debt due to the high-interest rates, short-term loan cycles, and lack of other loan options. High-interest rates lead to compounding debt, as the interest accumulates faster than you are able to repay the loan.

- Unregulated lenders make it difficult for borrowers to know the terms of the loan and the conditions of repayment, leading to potentially exorbitant fees or worsening debt cycles. The lack of other loan options makes it difficult for borrowers to find an alternative to payday and title lenders.

The main advantage of a credit union compared to a payday or title lender is the lower interest rates, fewer fees, and greater transparency.

High-Interest Rates

Payday and title lenders are notorious for charging high-interest rates that trap borrowers in a cycle of debt. Such lenders target low-income individuals who do not have access to traditional banking services, making it difficult for them to find alternatives to predatory loans.

There are other options available that offer lower interest rates and more favorable terms. One alternative is a credit union, which operates as a nonprofit organization owned by its members. Credit unions offer lower interest rates, including personal and auto loans.

They provide financial education and counseling services to help their members manage their finances effectively. Federal laws regulate credit unions and limit the interest they charge on loans. Borrowers at credit unions have the option to negotiate their interest rates based on factors such as their credit score and income level.

Choosing a credit union over a payday or title lender enables individuals to avoid the long-term effects of high-interest-rate loans and build a healthier financial future for themselves and their families.

Unregulated Lending

There are alternative options to payday and title lenders. However, many individuals still turn to high-interest-rate loans due to a lack of knowledge or access to other financial resources. The risks and pitfalls associated with such lending have long-lasting effects on borrowers’ financial well-being.

One major issue with payday and title lenders is that they usually operate outside traditional loan regulations, leaving little borrower protection in place. Hidden fees, aggressive collection practices, and debt traps are all common occurrences within the industry. Lack of proper financial literacy education or access to more regulated lending sources such as credit unions contributes to low-income individuals getting stuck in an endless cycle of debt caused by predatory loans.

Debt Traps

Many individuals cannot repay the full amount borrowed by the due date due to their high-interest rates and short repayment terms. It leads them to obtain another loan with even higher fees to cover the original loan and interest.

The result is a vicious cycle that is nearly impossible for low-income individuals to break free from. Borrowers must seek alternatives or educate themselves on more regulated lending sources such as credit unions to prevent falling into such a situation.

Conclusion

Many use payday or title lenders as a quick solution when borrowing money. Significant risks and pitfalls are associated with such loans, including high-interest rates and predatory lending practices. On the other hand, credit unions offer an alternative option to provide borrowers with lower interest rates and more favorable terms. One key advantage of choosing a credit union over a payday or title lender is the ability to secure a loan at a significantly lower interest rate.

The average interest rate on a 12-month personal loan from a credit union was just 9.69%, compared to an average APR of 400% for a payday loan, according to recent data from the National Credit Union Administration (NCUA). It means that borrowers who choose credit unions over payday or title lenders potentially save thousands of dollars in interest charges over the life of their loan.

Payday and title lenders seem attractive for people needing quick cash, but they have significant risks with long-term financial consequences. Credit unions allow borrowers to obtain loans at much lower interest rates and more favorable terms.

Frequently Asked Questions

How do credit unions differ from payday lenders in terms of interest rates and fees?

Credit unions offer much lower interest rates and fewer fees compared to payday lenders. For example, payday loan APRs can exceed 400% versus credit union rates of 18-28%.

What are the key benefits of borrowing from a credit union instead of a title lender?

Benefits include lower rates, fee caps, non-predatory lending, financial counseling, and the ability to build savings and credit history. Title lenders have fewer protections.

Can credit unions provide a more affordable alternative to payday loans for short-term financial needs?

Yes, credit union payday alternative loans typically have APRs below 30%, fixed terms, and reasonable limits, making them more affordable than traditional payday loans.

What types of financial products and services do credit unions typically offer that payday and title lenders do not?

Credit unions offer things like savings accounts, checking, credit builder loans, credit cards, mortgages, investment services, and retirement accounts, which payday/title lenders do not.

Are there any eligibility requirements or membership criteria to join a credit union, and how do they compare to the requirements of payday or title lenders?

Credit unions have membership criteria like locale, employer, family, or associations, but these are generally easy to meet. They are much less restrictive than payday or title lenders focused solely on income.