How Do Installment Loans Online Work?

Online Installment Loans work similarly to traditional installment loans, and the application and funding process is online. Borrowers complete the application process, submit required documents, and receive funds electronically without ever having to visit a physical location.

Online Installment Loans are convenient and accessible options for borrowers who need quick access to funds and prefer to complete the application process from their homes. Borrowers start by filling out an online application form with personal and financial information to apply for an Online Installment Loan. The lender reviews the application and requests other documentation or information to verify the borrower’s identity, income, and creditworthiness. One type of installment loan is long-term installment loans with a longer repayment period. Once they approve the loan application, lenders send the borrower a loan offer that includes the loan amount, interest rate, fees, and installment loan payments.

Understanding Installment Loans

An installment loan is a type of loan that requires repayment in equal payments over a fixed period. The payments consist of both principal and interest, and they are every month. The amount borrowed, interest rate, and length of the loan are all factors that determine the cost of an installment loan. Some lenders charge other fees like origination fees or late payment penalties, which they consider in obtaining an Installment Loan.

Some lenders require collateral for these types of loans to decide to get an Installment Loan. Note that borrowers must have good credit to qualify for an installment loan. They use credit scores to assess risk before approving a loan application. Higher credit scores indicate lower risk and vice versa. Applicants applying for an Installment Loan must be confident in making the monthly installments requirement. Refusing to do so results in late debt installments, failure to miss payments, or defaulting on the loan.

By exploring the benefits of installment loans, potential borrowers can better understand their purpose and usefulness. Additionally, it’s important to be aware of the drawbacks of installment loans to make an informed decision.

What Are the Benefits Of An Online Installment Loan?

One of the main advantages of online installment loans is the flexibility in their installment loan terms. This allows borrowers to choose a repayment schedule that suits their financial needs.

The benefit of Online Installment Loans is that they offer convenience and flexibility, allowing individuals to apply for a loan from the comfort of their homes. They have faster processing times than traditional loans, with funds deposited directly into the bank account in as little as one business day. Online Installment Loans are helpful tools for managing unexpected expenses or consolidating debt, providing borrowers with the loan proceeds they need to cover the expenses and a predictable repayment plan. One of the primary advantages of these loans is the variety of installment loan options available, ensuring that borrowers can find a loan that suits their specific needs. Additionally, installment payments make it easier for borrowers to budget and plan for the future, as they know exactly how much they need to pay back each month.

- Flexibility – Online installment loans allow borrowers to choose their repayment period, unlike traditional loans, such as examples of installment loans, which range from a few months to several years. Its flexibility helps borrowers manage their cash flow and budget better.

- Convenience – Applying for an online installment loan is quick and easy, and borrowers complete the process from their homes. It benefits individuals who live in rural areas or have limited access to traditional lending institutions. Installment credit is a significant advantage for those seeking convenient loans.

- Lower interest rates – Online lenders have lower overhead costs than traditional lenders, translating into lower interest rates for borrowers. It saves borrowers money over the life of the loan. Compared to a common installment loan, online loans offer more attractive interest rates.

- No collateral is required – Many online installment loans are unsecured, which means borrowers don’t have to put up any collateral to secure the loan. It is helpful for individuals who don’t have valuable assets to pledge as collateral, unlike some examples of installment loans that might require security.

- Improved credit score – Making on-time payments on an online installment loan helps borrowers improve their credit scores. By consistently paying off their installment credit, they make it easier for them to qualify for other types of loans and credit in the future.

- Faster access to funds – Online lenders have faster application and approval processes than traditional lenders, which means borrowers have access to their funds more quickly. It is for individuals who need money for emergency expenses and don’t want to wait for the lengthy processing times associated with a common installment loan.

What Are The Requirements For An Installment Loan?

The requirements for installment loans vary depending on the lender and the specific type of loan, including various forms of installment debt. Borrowers need to meet certain requirements to qualify for an installment loan. The approval process might differ among lenders, but there are some standard requirements that one needs to fulfill. These include being at least 18 years old, having a steady source of income, possessing a valid government-issued photo ID, and having an active checking account in their name. Sometimes, a signed loan agreement between the borrower and the lender might be requested. Listed below are some standard requirements that lenders require.

- Personal Information – Applicants must provide their full name, address, date of birth, and contact information.

- Income and Employment – Applicants must provide proof of income and employment, like pay stubs, bank statements, or tax returns, to show that they have a stable source of income and afford to make the monthly payments on the loan.

- Credit Score – Lenders check applicants’ credit scores and history to assess their creditworthiness and loan repayment ability.

- Debt to Income Ratio – The debt to income ratio is the amount of debt one has to compare to their income. Lenders use the ratio to determine if they afford to repay the loan. Considering the cons of installment debt when evaluating the debt-to-income ratio is crucial.

- Identification – Applicants must provide a valid government-issued ID, like a driver’s license, passport, or state ID.

- Bank Account – Applicant must have an active bank account to receive the loan funds and make monthly payments.

- Social Security Number – Provide applicants with a Social Security number for identity verification.

- Collateral – Some installment loans, like a car or property, require collateral to secure the loan. This requirement may lead to potential cons of installment debt if the borrower cannot make the payments and faces asset seizure.

- Age- Be 18 to apply for an installment loan.

- Citizenship/Residency – Lenders must be U.S. citizens or permanent residents of the U.S.

How to Find A Reputable Online Lender For Installment Loans?

Finding a reputable lender includes the following:

Researching the lender.

Checking customer reviews.

Verifying credentials and licenses.

Comparing their interest rates and fees to borrowers of other lenders.

Here are the procedures for finding a reputable online lender for Installment Loans.

- Research the lender. Research the lender before applying for a loan, whether it’s unsecured loans or other types. Check their website, read reviews and ratings from other borrowers, and look for information about the lender’s history and reputation.

- Check for licensing and accreditation. Check if the lender is licensed to operate in the state and has accreditation by reputable organizations like the Better Business Bureau or the Consumer Financial Protection Bureau, especially when offering unsecured loans.

- Review loan terms and fees. Read the loan terms and fees, including the interest rate, repayment period, and associated fees for unsecured loans. Know the total cost of the loan and how it affects the budget.

- Check for a secure website and data protection. Verify that the lender’s website is secure and uses encryption to protect personal and financial information, particularly when applying for unsecured loans.

- Contact customer support. Contact the lender’s customer support team with any questions or concerns from borrowers regarding unsecured loans. A responsive and helpful customer support team indicates lenders value their customers and are committed to providing good service.

- Compare lenders. Shop around and compare different lenders to find the best loan terms and interest rates that fit individual needs and budgets for unsecured loans. Don’t settle for the first lender borrowers find.

How To Apply For An Installment Loan Quickly

The steps to apply for an installment loan quickly include:

Gathering necessary documentation and information.

Researching and comparing different lenders.

Completing the online application.

Reviewing the loan terms before signing the agreement.

Borrowers increase their chances of getting approval for an Installment Loan and receiving the funds quickly by following the steps. It is crucial to consider the period of time for loan repayment and the period of time it takes to process the application to ensure a smooth experience.

- Check credit score and perform a Credit Check. A few lenders check the credit score to know if a person meets the lender’s minimum credit requirements before applying for an installment loan. A Credit Check is essential to determine a borrower’s creditworthiness. Borrower checks their credit score for free through various credit monitoring services. Those with excellent credit will have an easier time getting approved, while poor credit borrowers may face more difficulty.

- Gather the financial information. Collect pay stubs, bank statements, and any other information the lender requires.

- Choose a lender. Research and compare lenders to find the best loan terms and interest rates for one’s needs. Some lenders may cater specifically to those with excellent credit or poor credit borrowers.

- Apply online. Complete the installment loan applications online to make the process quick and convenient. Fill out the online application form and provide the information and documents.

- Wait for approval. The lender reviews the information and decides against applying.

- Receive the loan funds. The lender deposits the loan funds directly into their bank account after approval of the loan application.

What Are Different Types of Installment Loans?

The different types of Installment Loans available to borrowers are Personal, Auto, Mortgage, Student, Payday, and Title Loans. Personal loans are unsecured, have fixed interest rates, and are used for various purposes. Auto loans finance the purchase of a vehicle and have varying interest rates and repayment periods. Mortgage loans help purchase or refinance a home and have low-interest rates but require a down payment and a good credit score. Student Loans finance the cost of higher education. Payday and title loans have high-interest rates and use postdated checks or collateral to secure the loan.

Personal Loans

Personal loans are used for various purposes, including debt consolidation, home improvement, or unexpected expenses. Unlike mortgage loans, personal loans are unsecured, meaning they do not require collateral, like a house or car, to secure the loan. Personal loans have fixed interest rates and repayment terms, and the loan amount and interest rate are determined based on the borrower’s credit score and income. Personal loans provide borrowers quick access to funds but have higher interest rates and fees than other loans.

Auto Loans

Auto loans are part of the car buying process for many consumers, as they provide a way to finance the purchase of a vehicle over time. Banks, credit unions, or other financial institutions offer Auto Loans. The terms of an auto loan include the loan amount, the interest rate, and the repayment period. The interest rate on an auto loan varies depending on the borrower’s creditworthiness, the loan amount, and the repayment period’s length. Auto loan repayment periods range from a few years to several years, depending on the borrower’s needs and the lender’s requirements. The lender repossesses the vehicle if the borrower fails to repay the loan.

Along with auto loans, credit cards and lines of credit are popular options that help manage financial needs. These options also come with their own set of interest rates. The average interest rate can vary depending on various factors, such as the user’s credit score and the credit product.

Mortgage Loans

Mortgage loans purchase or refinance a home, where a lender provides funds to the borrower to purchase or refinance a property. There are common types of mortgage loans with different interest rates, such as fixed interest rates or variable interest rate. The borrower must make monthly payments on time with interest over a specified period until the loan is fully paid off. Mortgage loans have lower interest rates than other loans but require a down payment and a good credit score.

Student Loans

Student Loans help students pay for the cost of higher education, like tuition, fees, books, and living expenses. The total amount of student loans that a student borrow depends on various factors, including their financial need, the cost of attendance at their school, and their status as a dependent or independent student.

Payday Loans

Payday loans are short-term, high-interest loans that borrowers use to cover unexpected expenses or financial emergencies. Payday lenders offer payday loans to borrowers who provide a postdated check or access to their bank account as collateral for the loan.

Title Loans

Title loans are loans in which a borrower uses their vehicle’s title as collateral to secure a loan. These loans often have high-interest rates and are typically meant for short-term financial needs.

Title Loans use the borrower’s car title as collateral. The borrower gives the lender the title to their vehicle, like a car or motorcycle, in exchange for a loan amount that is usually a percentage of the vehicle’s value. The lender becomes the lienholder on the vehicle’s title until the borrowers pay the total amount due. Title Loans have high-interest rates and fees and must be repaid quickly. They often come with a credit limit based on the vehicle’s value. Lenders may also offer variable rates and more favorable terms for borrowers with good credit scores.

Does Credit Score Affect Installment Loans?

Yes, credit score affects Installment Loans. It plays a role in determining the eligibility and terms of installment loans. The lender checks the borrower’s credit score and credit history to evaluate their ability to repay the loan when a borrower applies for an installment loan. A higher credit score indicates a lower risk of default, resulting in lower interest rates and better loan terms, often including a higher credit limit and favorable terms. A lower credit score leads to higher interest rates, loan application denial, and the possibility of higher variable rates.

Installment Loan Fees and Amount

Installment loans have various fees and loan amounts, depending on the type of loan and lender. Personal loans have origination fees, a percentage of the loan amount. Common fees include origination fees, application fees, prepayment penalties, late fees, and other charges. In addition, the payment schedule is another essential factor to consider when opting for a loan. Here is the table for Loan Fees, Loan Amounts, and Payment Schedule by State.

| State | Origination Fees | Late Payment Fees | NSF Fees | Minimum Loan Amount | Maximum Loan Amount | Payment Schedule |

| CA | $75 flat fee or 5% of the loan amount | $15 flat fee | $15 per payment returned | $450 | $10,000 | Monthly, bi-weekly, or weekly |

| TX | 10% of the loan amount | $30 flat fee or 5% of the delinquent payment amount | $30 per payment returned | $500 | $10,000 | Monthly or bi-weekly |

| FL | $100 flat fee | 5% of the monthly payment amount or a $5 flat fee | $35 per payment returned | $500 | $5,000 | |

| GA | 5% of the loan amount | 5% of the monthly payment amount or a $5 flat fee | $25 per payment returned | $550 | $5,000 |

Scenario 1 Origination Fees

The table shows the different origination fees World Finance charges in different states. Origination fees are flat amounts or a percentage of the loan amount, depending on the state. The origination fee is a $75 flat fee or 5% of the loan amount. It is 5% of the loan amount in Georgia. The table shows each state’s minimum and maximum loan amounts.

Scenario 2 Late Payment Fees

Lenders charge late fees if borrowers make payments after any grace period state law allows. The table shows the different late payment fees charged by World Finance in different states. Late payment fees are:

Flat amounts.

A percentage of the monthly payment amount.

A percentage of the delinquent portion of the monthly payment amount.

The late fee is either 5% of the monthly payment amount or a $5 flat fee in Florida. It is a $30 flat fee or 5% of the delinquent payment amount in Texas.

Scenario 3 NSF Fees

The NSF fees vary depending on state law and range from $10 to $50 per payment returned. The table shows the different NSF fees, World Finance charges in different states.

Scenario 4 Loan Amounts

For borrowers with bad credit, loan amounts can vary significantly. Lenders may impose higher interest rates or stricter requirements for borrowers with bad credit. It’s important to understand the impact of your credit history on the terms and availability of loans. Review your credit report and take steps to improve your credit score before applying for a loan.

Larger loans are available in some states. The table shows the minimum and maximum loan amounts available in each state. Loan amounts require a first lien on a motor vehicle that meets value requirements, titled in the borrower’s name, with valid insurance. Loan approval and actual loan terms depend on the borrower’s ability to meet credit standards, including a responsible credit history, sufficient income after monthly expenses, and availability of collateral.

How Long Does It Take To Receive The Funds From An Installment Loan?

The time it takes to receive the funds from an installment loan varies depending on several factors, like the lender, the loan amount, and the method of disbursement. Borrowers receive the funds as soon as the next business day after the approval of the loan application. Some lenders take longer to process the application and disburse the funds, which takes several business days or weeks. Choose to receive the funds via a physical check. It takes extra time for the check to arrive by mail and for the funds to be available in the account. Check with the lender regarding their specific timeline for disbursing funds to know when to receive them.

Frequently Asked Questions

What are installment loans, and how do they differ from other types of loans?

Installment loans provide fixed amounts repaid with regular principal and interest payments over a set repayment schedule and term. Unlike payday loans, installment loans allow longer repayment periods.

How can I apply for an installment loan online, and what information is typically required?

To apply for an online installment loan you generally need to provide personal information like employment status, income, bank account details, government ID, and references. Credit checks are also usually required.

What factors determine the interest rates and terms of online installment loans?

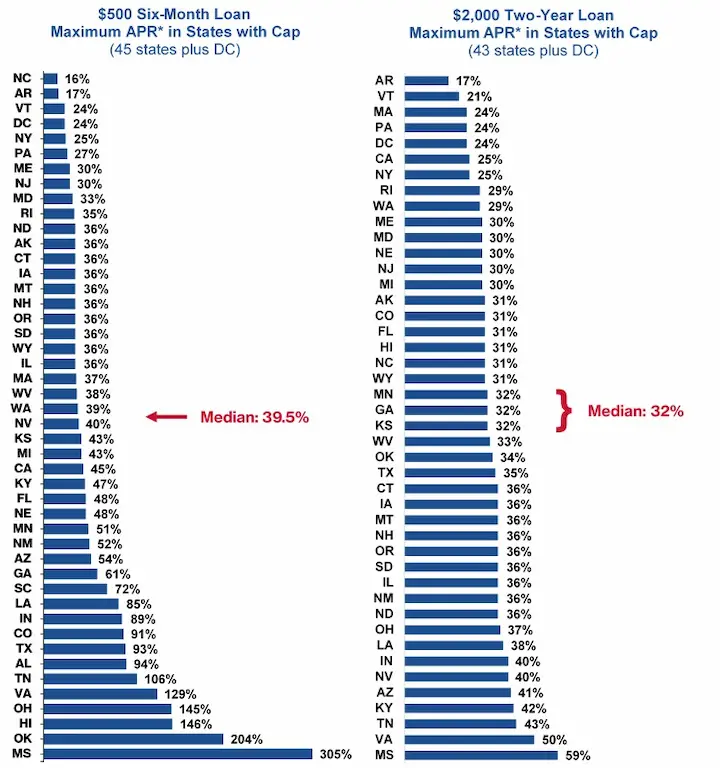

Interest rates and terms for online installment loans depend on the lender, loan amount, your credit score and history, income verification, debt-to-income ratio, and state regulations.

Are there any specific eligibility requirements or credit score criteria for online installment loans?

Eligibility often requires a minimum credit score from 580-640 or higher, steady verifiable income, and being at least 18 years old. Lending criteria can vary by lender.

What are the advantages and disadvantages of using online installment loans compared to traditional bank loans?

Advantages include faster approvals, flexible terms, accessible credit for those with limited credit history. Disadvantages are higher interest rates and fees compared to personal bank loans.