North Dakota Payday Loans – Online Cash Advance

Rixloans in North Dakota is a loan‐connecting service that helps you request funds online from a network of reputable lenders. We understand that even the most prepared people may face financial difficulties at one point, such as bad credit scores, unexpected expenses, or even medical bills.

If you’re facing financial issues, submitting a loan request for payday loans in North Dakota through RixLoans may be the answer you’re seeking. Our online network connects you with reputable lenders as a better alternative to traditional payday lenders. Please note that submitting a loan request does not guarantee approval, as final decisions are made by our lending partners.

An online payday loan is a viable solution if you require extra help to make it to the next payday, especially for emergency expenses. It’s easy to get the fast funds you need by creating an online loan request that’s quick, simple, straightforward, and accessible. You don’t have to wait around for money! Please note that your loan request is subject to review by our network of lenders.

Request a Payday Loan in North Dakota

If an unexpected incident leaves you low on cash and you need urgent payday loans, Rixloans makes it simple to obtain one. You can easily submit your loan request and manage your financial situation without the hassles of dealing with banks and other loan providers. You’ll quickly see your potential loan options with us based on factors like your monthly income. We offer manageable monthly payments for this type of loan and work only with reputable lenders to ensure your satisfaction.

People living in North Dakota can submit a loan request online and view their potential loan options quickly! The entire process takes about a minute and requires just a few details about your financial status and personal traits. What’s the reason to wait?

Request a Payday Loan Online from Lenders

The online lending platform loan request requires essential information such as your address, phone number, and date of birth. We also need details on your job title and source of income.

Criteria for Payday Loans: How To Qualify For Online Payday Loans Within North Dakota?

- You must have an active bank checking account. Bank Account

- Proof of income ( Monthly salary, utility bills, etc.)

- ID

- Minimum requirements: at least 18 years old

Requesting payday loans has never been easier. Once you have completed the loan request forms, you’ll quickly see potential loan options based on your submitted information. This streamlined process allows you to address your financial emergency quickly with reasonable repayment terms. Remember the eligibility requirements and submit your Social Security Number when requested for a smooth process.

Funds are usually available in your account on the next business day. Same-day funding may be possible if you submit your loan request before 10 AM, subject to review by our lending partners.

Online Document Signatures

Payday loans provide digital Signatures (e‑signature) to prove that you have read all the documents governed by specific North Dakota regulations. These loans cater to people with credit scores, even those with poor credit scores. Lenders offer these individuals various types of loans with flexible terms, such as flexible repayment options and flexible repayment plans. In most cases, they also provide quick decisions on your loan request.

Register online, and you’re good to start! North Dakota loan terms, as well as other loan agreements, are accessible on the Internet. You do not need to worry about mailing or printing acknowledgments with us.

Customers can receive funds through Rixloans’s rapid funding program. The process is designed to be fast, taking as little as a minute to complete, though final funding may take up to 30 minutes. This allows for quick access to funds in an emergency situation. Lenders offer loans to people who meet their basic requirements, including a minimum credit score. The loan amount and terms vary, and final decisions are based on several factors, such as credit history.

The customer’s financial institution determines the funds transferred. If funds are not available immediately, they will typically be deposited on the next business day. This process ensures that individuals in need can receive assistance, including those receiving Social Security benefits.

What Are Payday Loans and How Do They Work?

The term “payday loan” refers to a small loan amount that is repaid in one lump sum after you receive your next paycheck. These loans are short-term financial tools that provide extra funds for a limited period.

These loans can cover unexpected costs that arise on payday. Imagine you’ve just paid your rent or mortgage, which takes up two‑thirds of your salary.

Then you fracture your tooth on the following day. It’s time to have the tooth repaired, but you don’t have the money to pay the dentist. With its fast service and quick response on your loan request, a payday loan can be a convenient option for situations like these.

Payday loans’ maximum loan amounts are typically up to $500‑1000. Some states have limitations on the entire sum of the loans, like in California, $255. Lenders design them for bad‑credit borrowers and high‑risk borrowers who may have difficulty obtaining personal loans or other forms of credit from traditional banks. Late payments and poor credit history are often more acceptable for cash advance loan providers than conventional lenders.

It’s essential to consider Alternatives to payday loans and look into internet payday loans based on your specific needs, location, and eligibility criteria. Regardless of the type of loan you choose, always read the terms and conditions carefully to understand the costs and repayment terms.

A payday loan can give you the few hundred dollars you require to cover unexpected expenses without having to wait for your next paycheck. Short‑term loans are an alternative to traditional loans when you need funds quickly.

Payday loans usually have terms between 14‑day loan term and 30‑day loan term. The online loan request process is fast and easy via rixloans.com. Read the terms and conditions carefully before making commitments, and check for loan offers from different lending partners.

In the vast expanse of North Dakota, Rixloans connects you with lending partners in several key cities, offering reliable and convenient payday loan services to meet the financial needs of individuals and businesses alike. Below, you will find a table highlighting the most important cities where our lending partners operate, ensuring that residents across the state can access the financial support they require during challenging times. Our commitment to exceptional service and a streamlined loan request process has allowed us to become a trusted name in connecting borrowers with timely financial solutions. Take a look at the table below to discover the cities where our services are readily available, empowering North Dakotans with the means to address their short‑term monetary requirements.

| Fargo | Bismarck | Grand Forks |

| Minot | West Fargo | Mandan |

What You Should Know Before Requesting a Payday Loan

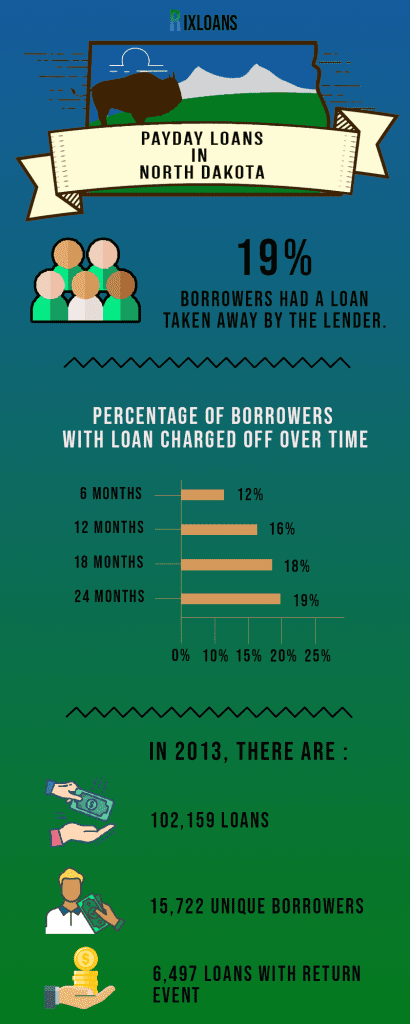

Payday loans pose a greater danger for lending institutions like credit unions and traditional lenders than other borrowers. The annual percentage rate can be up to 500 percent. Review your bank statement and your income ratio to determine if you can afford the loan. Also, examine customer reviews to understand the lender better.

Suppose you are a resident or working within Minot or Fargo. In that case, our service aims to connect you with lending partners who can help ensure you can repay the cash advance you request online without being overwhelmed by the costs. Verify if you have a steady income to meet repayment deadlines and avoid late payment fees. Consider alternative solutions like credit unions or utility assistance programs to cover essential bills or discuss your type of income with the lender.

Conclusion

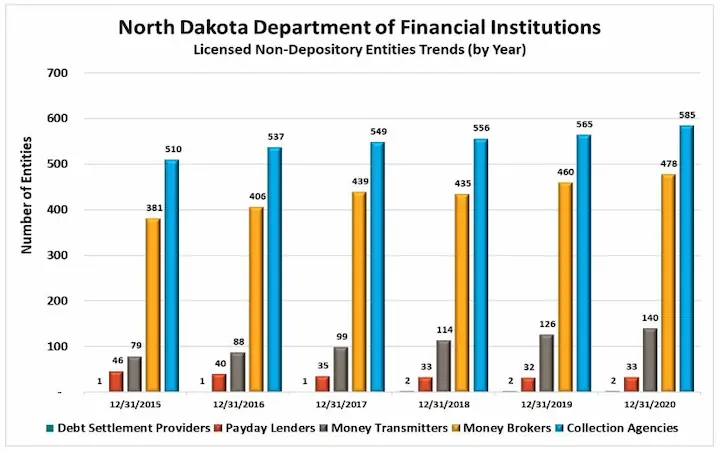

North Dakota stands out by ensuring that payday lending operates under in‑state licensing and routine checks. This distinct approach sets it apart from some neighboring states where people might be pushed towards unofficial online channels. Even though there might be instances of rates surpassing 500% APR, North Dakota is committed to providing a regulated local platform for those seeking credit. Future reforms might look into introducing boundaries on interest rates to counteract excessive lending practices while keeping the benefits of official in‑state provisions. A closer look at Minnesota, South Dakota, and Montana reveals varied methodologies.

Frequently Asked Questions

Can individuals with bad credit in North Dakota obtain payday loans without a credit check, and how does the process work?

No, North Dakota requires all payday lenders to assess an applicant’s ability to repay through credit reports and income verification. There are no lawful “no credit check” payday loans available in the state.

What are the eligibility criteria for securing payday loans in North Dakota for individuals with bad credit?

North Dakota prohibits payday lending without credit checks, so there are no legitimate eligibility criteria associated with illegal “no credit check” payday loan products being marketed unlawfully to state residents.

Can you explain the interest rates and repayment terms typically associated with payday loans in North Dakota for those with bad credit?

Payday lenders in North Dakota must perform credit checks, so any advertised rates or terms for illegal “no credit check” loans likely indicate unlawful predatory lending practices that consumers should avoid.

Are there any state-specific regulations or consumer protections in North Dakota regarding payday loans for individuals with bad credit?

Yes, North Dakota mandates credit checks and ability to repay assessments for all payday loans under state statutes. Regulations prohibit “no credit check” payday loan products.

How can I find reputable lenders in North Dakota known for providing payday loans to individuals with bad credit?

It is not recommended trying to find any “no credit check” payday loan offers, as those would be illegal in North Dakota. Consumers should consult state regulators for guidance and lists of properly licensed lenders.