Ohio Payday Loans Online – Fast Funding Options

An Ohio Payday Loan from RixLoans is a short-term, high-interest loan typically due on your next payday. The maximum amount you can borrow with Ohio payday loans is $1000. The minimum term for a payday loan in Ohio is 31 days. The maximum term is 90 days.

The payday loan request process is designed to assist people with unexpected expenses. The maximum finance charge for a payday loan in Ohio is $15 per $100 borrowed. If you borrow $300, you will pay $45 in interest. The maximum APR for a payday loan in Ohio is 28%. If you borrow $300, you will repay $384 throughout your loan.

RixLoans is a loan‐connecting service that can quickly evaluate your financial situation and connect you with potential lenders who may provide funds within one business day. To qualify, you need a regular source of income, and our network of online lenders makes it easy to obtain Online payday loans.

Can I Renew or Extend My Payday Loan?

No, you cannot renew or extend your day payday loan in Ohio. Once your loan is due, you must repay it in full or default. If you default, the lender can sell your loan to collection agencies. These agencies could take further action against you. This could include wage garnishment or seizure of assets. You must be in employment to get a payday loan in Ohio. The lender will check with your employer to verify your current work.

The loan terms for online loans with RixLoans accommodate a variety of situations, even if you have a bad credit score. The monthly payments and interest rates are set by financial institutions according to your unique needs.

The online loan request process is designed to be simple, and loan requests can be approved for various loan amounts. Requesting a payday loan online with RixLoans means you can review the loan agreement in detail before accepting.

Flexible repayment terms make it easier for individuals with poor credit scores or limited credit history to obtain a loan. However, it is essential to remember that repeatedly renewing or extending your payday loan may result in further financial burden.

Instant payday loans can provide fast funds for those in need, especially compared to traditional lenders. Many reputable lenders offer competitive interest rates and instant approval (subject to lender review), making it easier to access funds. The loan request form can be found online, and filling out the online form takes only a few minutes.

Can I Get a Payday Loan With Government Benefits?

Yes, you can get a loan with government benefits. Payday loan providers often have a high acceptance rate for unemployed borrowers and bad credit borrowers. You can request a loan online or at a lender’s office. You must provide basic information, including your name, address, and Social Security number.

Repayment periods may vary, but it’s essential to make your payments on time to avoid negative impacts on your credit score. Even if you need funds for emergency expenses, you can still have access to funds through these loans.

Here are some examples:

Social Security Disability Insurance (SSDI) – This program benefits people who become disabled. People who qualify for SSDI can receive a lump sum payment every month. The amount varies depending on how long you’ve been receiving payments.

For a quick decision, ensure you have an active bank account and demonstrate your ability to repay the loan on time.

Supplemental Security Income (SSI) – This program provides financial assistance to people who cannot work due to a disability. Eligibility requirements vary by state. Some states allow people to use SSI benefits to pay off payday loans.

Can I Get Bad Credit Payday Loans?

You can request a payday loan even with bad credit. RixLoans typically reviews your credit score and considers other factors, such as your income and employment history, to connect you with potential lenders. The cost of getting a payday loan varies depending on the lender. You may pay an origination fee, a late payment fee, or an NSF fee. The money must be used for specific purposes, such as paying bills or rent. Do not use the funds for long-term needs.

Payday loan lenders are an option for people with a poor credit history. They offer flexible loan amounts and a relatively high chance of matching you with potential loan options. However, they may also charge high-interest rates compared to other borrowing options. To secure better terms and lower interest rates, consider working with a network of lenders that offer competitive rates and flexible repayment options.

If you are a permanent resident with a stable job but struggle with credit ratings, these loans may be an excellent choice. With minimal paperwork and a speedy review process, quick loans can be ideal for unexpected expenses. Also, some lenders may have minimum income requirements to increase your chances of connecting with potential loan options.

When Should I Avoid Getting a Payday Loan in Ohio?

You should avoid getting a payday loan in Ohio if you don’t have a stable source of income, plan to use it for long-term needs, or if you may qualify for a loan with better terms and lower interest rates. It’s essential to choose bad credit providers that offer the maximum loan amount with reasonable terms, considering the risks and costs associated with high-interest rates and late payment fees.

You should not request a loan if you cannot repay it. A payday loan is a short-term solution and should only be helpful in financial emergencies. You can check with the Better Business Bureau to see if a provider of payday loans is legitimate. You should also ensure that the lender has a license to operate in Ohio.

What Are the Alternatives to Taking Out a Payday Loan?

The following loan options are good alternatives to options for payday loans:

- Asking family or friends if they can help you during your financial difficulties.

- Looking for alternative providers of loans, such as credit unions or banks, which may offer a better annual percentage rate.

- Consider using your credit card, especially if it has a lower interest rate and more flexible payment terms.

- Checking if you qualify for financial assistance programs.

When choosing your ideal source for payday loans, it is crucial to consider this option for borrowers with a bad credit history. Also, don’t forget to weigh the pros and cons before deciding.

Basic Requirements for Payday Loan Eligibility

Before requesting a payday loan, it’s important to understand the Basic Requirements and loan eligibility criteria, which include:

- Being a legal resident of the state where you’re requesting the loan.

- Having an active checking account that allows for electronic transfers.

- Proof of income to show that you can repay the loan.

These requirements ensure a smooth review process for potential borrowers.

Quick Payday Loans for Those in Need of Extra Funds

Quick payday loans can be an ideal and convenient option for individuals who need some extra funds to cover unforeseen expenses. The quick loan review process for payday loans can be helpful in time-sensitive situations, but consider other loan options before deciding. Choosing a reliable provider of payday loans that fits your needs and financial situation is essential.

- Loan contract: A loan request form is essential for obtaining a loan contract from loan solutions providers. The funds will help you with diverse financial needs.

- Installment loans from RixLoans: Installment loans allow you to repay your loan over time. The amount borrowed is divided into smaller monthly installments.

- Credit cards: A credit card is another excellent alternative to a payday loan, especially for those with limited credit history. You can use it for emergency expense coverage.

- Home equity line of credit: Your home equity can finance a new vehicle or consolidate debt, an alternative option for individuals with urgent financial needs.

- Refinance your mortgage: Refining your mortgage allows you to reduce your interest rate without paying upfront costs. It is ideal for homeowners looking for a lending option in urgent situations.

- Get a side job: If you don’t want to borrow money, try getting a side gig. This could include babysitting, dog walking, tutoring, or other cash‐based opportunities. It is a more responsible approach to handling your finances.

In Ohio, our service actively connects individuals with reliable and convenient payday loan options. We understand the importance of financial support during challenging times, and our commitment extends to various cities across Ohio. Below, we present a table highlighting the most significant cities where our company operates, providing accessible and trustworthy solutions to meet your immediate financial needs. Whether you reside in Columbus, Cleveland, Cincinnati, or any other major cities listed, we are dedicated to assisting you with our convenient payday loan options.

| Columbus | Cleveland | Cincinnati |

| Toledo | Akron | Dayton |

| Parma | Canton | Lorain |

| Hamilton | Youngstown | Springfield |

| Kettering | Elyria | Newark |

What Are the Important Considerations Before Requesting Payday Loans?

Please remember that payday loans should only be a last resort and that other options like quick cash advance services are available to you if you need money quickly. Alternatives to payday loans include getting a cash advance from your employer, using a credit card, or exploring a variety of lenders offering loans on time with lower rates on payday loans. Ensure you evaluate your employment status and wide range of quick loan options before submitting your loan request, with lenders accepting all credit types for a quick review and access to funds without hassle.

You may also be able to get an installment loan or a financial option from a bank or credit union. Please contact us for more information if you have any other questions about payday loans. RixLoans would be happy to help you make informed decisions about your loan options!

Who Can Request Payday Loans in Ohio?

You must be employed, have an alternative stable income or steady income source, and meet the minimum requirements to request a regular payday loan in Ohio. The lender will check with your employer to verify your current work. As a financial services provider, we do not connect you with payday loans if you receive government benefits or lack legal residency.

The Loan amount offering or loan amount range varies depending on the lender. However, most lenders only offer loans up to $500 or $1000. Remember that loans with loan amount restrictions may be available through our reliable service even if you have less-than-perfect credit scores. We offer alternative options and consider other factors, such as a verifiable source of income besides traditional methods used by traditional banks.

Sometimes, you may need to provide bank statements and direct deposit information to prove your monthly income. Our loan-matching services work diligently to connect you with the right type of loan, including Bad Credit Loans if needed.

The loan must be repaid on your next pay date. If you cannot repay the full amount, you may be able to extend the repayment date or roll over the loan, although additional fees and interest charges may apply.

What Are the Requirements for Payday Loans?

To request a payday loan in Ohio, you must be employed, have a bank account, and be 18 years old. Unemployed people may still be eligible for certain types of loans, but the requirements may differ. You may also need proof of regular income and residency. The interest rate on a cash advance loan varies depending on the lender. However, it is typically very high and can amount to several hundred percent annually. Many online payday loan services have emerged to cater to these needs, offering a variety of payment options for different credit types.

What if I Don’t Reside in Ohio but Work There?

If you do not reside in Ohio but work there, you may still be eligible for a short-term loan through RixLoans. However, you will likely need additional documentation, such as proof of income and residency. For those with less-than-perfect credit, requesting funds with lenders accepting all credit types may be a viable option. These loan websites often provide quick assessments to evaluate your eligibility without affecting your credit reports from major credit bureaus.

For those seeking medium size loans or personal loans, these may be a suitable option when compared to traditional loans. If you’re not fully employed or have an unstable income, unemployed people may find these loans a reasonable option to satisfy their financial needs.

Conclusion

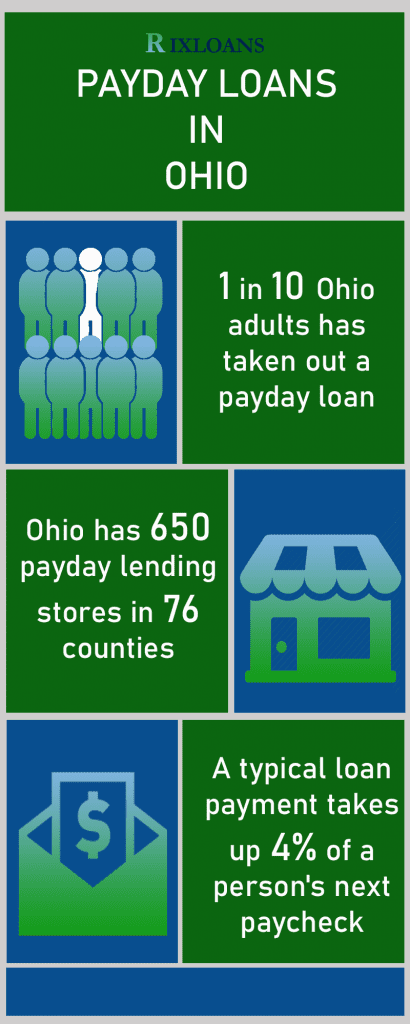

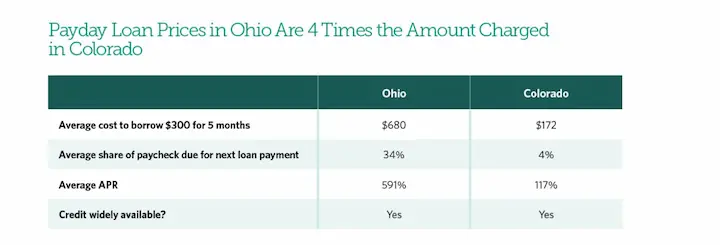

Previously, Ohio had no caps on payday loan interest rates. Recognizing the need to shield consumers, they introduced restrictions on high-interest payday lending. This didn’t mean the end of borrowing; regulated lenders still offer installment loans but at more competitive rates. The primary goal was not to just cap APRs over 600% but to seal off potential debt pitfalls. The state is in a continuous endeavor to find the middle ground between ease of access and loan affordability. By curtailing the unchecked high-cost loan products, Ohio ensures consumer safety while keeping valid borrowing options open. It’s worth noting that adjacent states like Michigan, Pennsylvania, Virginia, Kentucky, and Indiana have their unique regulations for payday lending.

Frequently Asked Questions

Are there payday lenders in Ohio that claim guaranteed approval without conducting a credit check, and how can I find reputable options?

In Ohio, lenders are required to review a borrower’s credit history and ability to repay, so no legitimate payday lender can offer guaranteed approval or truly “no credit check” loans.

What are the eligibility requirements for obtaining payday loans in Ohio?

Ohio requires credit checks for payday loans, so there are no specific eligibility criteria for “guaranteed approval” or “no credit check” loans. Any such claims likely indicate scams or predatory lending practices.

Can you explain the interest rates and repayment terms typically associated with payday loans in Ohio?

Ohio prohibits payday lending without credit checks, so there are no legitimate interest rates or terms associated with “no credit check” or “guaranteed approval” payday loan offers in the state.

Are there any state-specific regulations or consumer protections in Ohio regarding payday loans?

Ohio law protects consumers by prohibiting payday lending without credit checks. Consumers should report any claims of “guaranteed approval” or “no credit check” payday loans in Ohio to regulators.

How can I find reputable lenders in Ohio known for providing payday loans?

You can search online for legitimate payday lenders in Ohio. Reputable lenders will transparently explain their loan terms and verification policies upfront. Be cautious of any claims of guaranteed approval or no credit check offers, as these are not permitted by Ohio law.